How Can You Cash Bitcoin

On this website, you can sell Bitcoins in two ways- through online bank transaction. Therefore, the only viable way of avoiding tax, unless you qualify for nil-tax payments on earnings, is to sell you Bitcoins for cash in hand. However, this option will only work if you can find a buyer willing to pay. If the amount is over $10,000, you will also have to declare where the money came from to.

Bitcoin is the most popular form of cryptocurrency that’s why it’s drawing more and more attention. If you are interested in making money with Bitcoins, we will teach you different strategies to do it right.

Are you wondering why many are joining the bitcoin bandwagon? Are you asking yourself how they make money from this digital cryptocurrency? If you do, then we will give you the answers.

Bitcoin itself has a value that you can convert into cash, so it’s a great asset. But, aside from this, there are a number of ways to make money from bitcoin. If you want to profit from this digital currency, here are the different things you can do to grow your wealth through Bitcoin.

Contents

- 7 #7 Convert your Bitcoin Into Cash

#1 Writing

The cryptocurrency industry is still growing, but the online resources are scarce. As the interest for Bitcoin develops the demand for cryptocurrency writers and content creators will increase with it. So, if you love writing about bitcoins, you can potentially earn money from it.

As cryptocurrency writers, you can charge a premium for your service because of the complexity of the topics. Aside from writing informational content, a number of blockchain product companies pay active forum contributors to promote their product across popular platforms like Facebook and Reddit.

#2 Bitcoin Websites

Another great strategy to make money with bitcoin is by starting a Bitcoin website. Start a website and fill it with bitcoin-related contents that are relevant to those who are interested in this cryptorcurrency. Focus on anything from market trends and coin performance to explanations of advanced trading strategies.

There are endless amount of possible topics you can cover. Just make sure to provide relevant and helpful content. You can monetize your website through referral links and advertisement. The more visitors you have, the more money you’ll earn.

#3 Trade Bitcoins – Arbitrage

Another way to earn free Bitcoins is by trading. There are two methods in trading, the first way if you want to earn money is via arbitrate.

This is the safest way to earn from trading. This is the simultaneous buying and selling of assets to take advantage of differing prices. So, if you are into buying and selling, you can apply that skills here. There are multiple services that allows you to sell bitcoin. You can buy a Bitcoin at a lower price and immediately sell it for a higher price.

#4 Trade Bitcoins – Speculation

The speculation approach is risky. You would buy Bitcoins and wait until the price increases to sell it for a fiat currency. When the price drops, you will buy more. And repeat the process. You either need to be lucky or capable of predicting the future to make this work to your advantage.

There are people who are good traders and who can recognize patterns from price charts.

Here’s a number of sites that are best for Bitcoin trading.

- Coinbase. This is one of the most trusted platforms for trading cryptocurrency. It offers you the ability to trade a variety of digital assets on a secure, insurance backed platform.

- Bittrex. This site is designed for customers who want a lightning-fast trade execution, reliable digital wallets, and industry-leading security practices.

- Poloniex. This site includes advanced trading tools for trading, exchange and lending. It has cold storage and 24/7 monitoring to keep your money protected.

- Cryptopia. This supports literally hundreds of virtual cryptocurrencies with a low trading fee. It focuses on user experience with integration of additional services including marketplace and wallet.

- Gemini Exchange. This exchange is based in New York and is available in 48 US states and in other countries including Puerto Rico, Canada, UK, Singapore, South Korea and Hongkong. It has no deposit and withdrawal fees but charges 1% fee for trades to both the buyer and the seller.

#5 Lending

This is not as popular as the normal trading, but there are exchanges that allow you to loan your Bitcoin to other users. Sites like Bitfinex and Poloniex allows you to make money from your Bitcoin through margin funding.

When you margin fund, you will provide Bitcoin to other traders who are making leveraged margin calls. If you are willing to risk more, you can use the program SALT.

SALT allows you to leverage your blockchain assets to secure cash loans. In this way, you can make money from Bitcoins without having to sell your favorite investment.

SALT lending platform is a great option for those who need to make real-world expenditures but do not want to lose the potential gains from their digital currency holdings.

#6 Products and Services

Just like any new industry, since cryptocurrency is new, it opens new opportunities for you to create products and services. You can create a portfolio tracking app, a new cryptocurrency or blockchain-based games. There are plenty of options depending on your creativity.

#7 Convert your Bitcoin Into Cash

Bitcoins is a digital currency, but the great thing about this is that you can convert it into cash. Yes, you read it right, you can turn this into real money that you can hold and use for your future purchases.

If you have a bitcoin and want to turn it into a hard cash, you have several options, according to Sean Patterson.

Cashing Out Online

You can interact with a potential buyer directly and use an intermediary website to facilitate your connection with a certain fee. For this, you have to choose a financial service and create a seller’s account. When you’re account is ready, you can post a sell offer. Once you get paid, the website will transfer your cryptocurrency to the buyer.

For this you can use the following:

Coinbase. This financial service offers to transfer your bitcoins for free. But, if you are selling, you need to pay the service fee depending on what payout method you chose U.S. bank (1-2%), 1% for a Coinbase USD walled and 3.75% for PayPal

Bitbargain. This service has a variety of fees. If our ID is not verified you will be charged 0.005 BTC, the commission for trading operation is 1%. If you want to receive an SMS message you will have to pay 0.0003 BTC, and the banking verification procedure costs 0.02 BTC.

Cashing Out Offline

If you want to avoid service or cash withdrawal fees, you can also sell your bitcoins with a trade partner personally. For this, you can use special financial services that detect your geographical location and show the actual offers in your region.

Bitcoin Trading Exchange

Aside from trading with another person, you can find a trading platform that combines the features of Forex trading and Bitcoin exchanges. For this you have to open an account, place a sell order and state what type of currency you wish to sell and its amount. When a similar purchased is found, the exchange service will complete the transaction.

Kraken allows trading allows trading between bitcoins and EUR, USD, CAD, GPB and JPY. The trading fees are around 0.10% to 0.35%. This may vary depending on the quote currency volume. The processing fee for each paper copies of your communication is $60 per page. Meanwhile, the USD bank wire withdrawal is $5.

Bitfinex supports different digital currencies including bitcoins, litecoins and ethers. Its trading fee is around 0.10% to 0.20%, the bank wire fee is 0.100% with a minimum fee of $20, the express bank wire fee is 1.000% with a minimum fee of $20.

Cryptocurrency Converters

There are a number of ways to convert your bitcoins into cash. You can use an exchange service to instantly convert your digital currency into dollars, euros or other currencies. When the transaction is completed, you can withdraw the cash at ATMs using prepaid debit from one of the partner services offered by the site.

If you choose this route, make sure to only transact with legit sites. To do so, pay attention as to when the site was created and the reserve available for your chosen conversion pairs. Also, take the time to check their ratings and reviews.

Electronic Payment Systems

You can also perform all the conversion and withdrawal by yourself using a multi-functional electronic system. You can do this by opening a bitcoin account and then withdrawing the money using a wire transfer or prepaid debit card.

Conclusion

There are a number of ways to make money from Bitcoins. If you have tons of bitcoins, you convert it cash or trade it to earn money. If you don’t have bitcoins, you can still make money from it by working on bitcoin-related jobs.

References

- blockonomi.com/how-to-make-money-bitcoin/

- dailystar.co.uk/real-life/678831/how-to-make-money-with-bitcoin-cryptocurrency-cash-news

- ccn.com/earn-money-bitcoin-%E2%80%8B/

- coindesk.com/information/sell-bitcoin/

- coincentral.com/how-to-make-money-with-bitcoin/

- worldcore.eu/blog/5-efficient-ways-convert-bitcoins-cash/

The short answer is yes. The long answer… it’s complicated.

Bitcoin mining began as a well paid hobby for early adopters who had the chance to earn 50 BTC every 10 minutes, mining from their bedrooms. Successfully mining just one Bitcoin block, and holding onto it since 2010 would mean you have $450,000 worth of bitcoin in your wallet in 2020.

Bitcoin Mining Hardware Comparison

| Miner | Hash Power | Price | Buy |

|---|---|---|---|

| Antminer S19 Pro | 110.0 TH/s | $3,769 | |

| Antminer S19 | 95.0 TH/s | $2,767 | |

| WhatsMiner M30S++ | 112.0 TH/s | $2,850 | |

| WhatsMiner M30S+ | 100.0 TH/s | $2,550 | |

| AvalonMiner 1246 | 90.0 TH/s | $5,500 |

QUICK TIP

Unless you have access to very cheap electricity, and modern mining hardware then mining isn’t the most efficient way to stack sats. Buying bitcoin with a debit card is the simplest way

Ten years ago, all you needed was a reasonably powerful computer, a stable internet connection and the foresight of Nostradamus. These days, thanks to industrial bitcoin mining operations, it’s not such a level playing field and for a lot of people it makes more sense to simply buy some bitcoin on an exchange like Coinbase.

- Bits of Gold

- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

- Rain

- Exchange for Saudi Arabi, Oman, Kuwait, Bahrin, UAE

- Rain is based in Middle East

- High buying limits

- WazirX

- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

- CoinSpot

- Crypto exchange based in Australia

- Free & instant deposits

- Large selection of cryptos & live chat support

- CoinJar

- iOS & Android apps that let you trade

- Free & instant bank transfer with PayID / Osko / NPP

- Australian crypto exchange established in 2013

- eToro

- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

- Luno

- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

- Bitpanda

- Crypto exchange based in Europe

- Buy bitcoin with card, SEPA, SOFORT

- Trusted exchange

- Coinbase

- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- 'Instant Buy' option available with debit card

- Bitbuy

- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

- Netcoins

- Crypto exchange based in Canada

- Many payment methods available

- Get $10 CAD upon making $100+ in trades

- Coinberry

- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports credit & debit card, Interac, wire

- CoinJar

- iOS & Android apps that let you trade

- Free & fast bank transfers

- Crypto exchange established in 2013

- eToro

- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

If you’re motivated to learn, and you want to get a semi-passive income of bitcoin, then there are a few basics to get your head round, before working out if it’s even possible for you to profit from bitcoin mining.

Mining is the backbone of all proof-of-work blockchains and can be described with three key concepts:

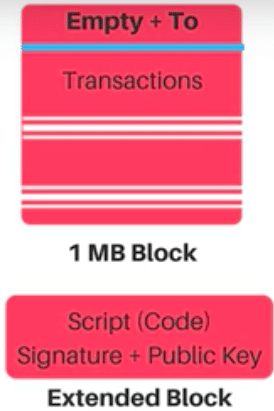

Transaction Records

The verification and addition of transactions to the public blockchain ledger. This is where you can view every single transaction that has ever occured in the history of the blockchain.

Proof-of-Work Calculations

The energy-intensive puzzle that each Bitcoin mining machine solves every ten minutes. The miner that completes the puzzle before anything else adds the new block to the blockchain.

Bitcoin Block Reward

Rewarded with 6.25 bitcoins. This number will reduce to 6.25 bitcoins after the halving in May 2020. The reward (plus transaction fees) are paid to the miner who solved the puzzle first.

This process repeats approximately every 10 minutes for every mining machine on the network. The difficulty of the puzzle (Network Difficulty) adjusts every 2016 blocks (~14 days) to ensure that on average one machine will solve the puzzle in a 10 minute period.

Network difficulty is calculated by the amount of hashrate contributing to the Bitcoin network.

What is Hashrate?

Hashrate is a measure of a miner’s computational power.

In other words, the more miners (and therefore computing power) mining bitcoin and hoping for a reward, the harder it becomes to solve the puzzle. It is a computational arms race, where the individuals or organizations with the most computing power (hashrate) will be able to mine the most bitcoin.

How Can You Cash In Bitcoin

The more computing power a machine has, the more solutions (and hence, block rewards) a miner is likely to find.

In 2009, hashrate was initially measured in hash per second (H/s) - Due to the exponential growth of mining, H/s was soon commonly pre-fixed with the following SI units:

| Kilohash | KH/s (thousands of Hashes/second) |

| Megahash | MH/s (millions of Hashes/second) |

| Gigahash | GH/s (billions of Hashes/second) |

| Terahash | TH/s (trillions of Hashes/second) |

| Petahash | PH/s (quadrillions of Hashes/second) |

To try and put this into perspective, let’s look at how much revenue 1 TH of power can earn mining bitcoin. As the global hashrate is usually growing the revenue per TH for each miner is usually falling, - and the revenue chart for 1 TH/s looks like this:

When you consider how many TH/s there are in the entire Bitcoin network though, you get a true sense of the scale of the industry:

85 Exahash = 85,000,000 Terahash

That means in May 2020 the daily revenue, globally, for Bitcoin mining is: $8.45M

How do Bitcoin miners calculate their earnings?

You’ve probably heard the scare stories about Bitcoin mining’s energy consumption.

Regardless of whether the impact is overblown by the media, it’s a fact that the underlying cost of mining is the energy consumed. The revenue from mining has to outweigh those costs, plus the original investment into mining hardware, in order to be profitable.

Mining Revenue

In 2020, one modern Bitcoin mining machine (commonly known as an ASIC), like the Whatsminer M20S, generates around $8 in Bitcoin revenue every day. If you compare this to the revenue of mining a different crypto currency, like Ethereum, which is mined with graphics cards, you can see that the revenue from Bitcoin mining is twice that of mining with the same amount GPUs you could buy for one ASIC. Thirteen AMD RX graphics cards cost around the same as one Whatsminer M20s.

WARNING

This graph shows you the daily revenue of mining Bitcoin. It does not take into account the daily electricity costs of running a mining machine. Your baseline costs will be the difference between mining profitably or losing money. GPU mining for Ethereum is more efficient than mining with Bitcoin with an ASIC machine

You can think of it as though the miners are a decentralized Paypal. Allowing all the transactions to be recorded accurately and making a bit of money for running the system.

Bitcoin miners earn bitcoin by collecting something called the block reward plus the fees bitcoin users pay the miners for safely and securely recording their bitcoin transactions onto the blockchain.

What is the Block Reward?

Roughly every ten minutes a specific number of newly-minted bitcoin is awarded to the person with a mining machine that is quickest to discover the new block.

Originally, in 2009, Satoshi Nakamoto set the mining reward at 50 BTC, as well as encoding the future reductions to the reward.

The Bitcoin code is predetermined to halve this payout roughly every four years. It was reduced to 25 BTC in late-2012, and halved again to 12.5 BTC in the middle of 2016.

Most recently, in May 2020, the third Bitcoin halving reduced the block reward to 6.25 BTC.

Mining is Not the Best Way to get Bitcoins

If you think the above seems complex, we agree.

How Do You Get Bitcoin Cash

Mining Bitcoin is NOT the best way to get bitcoins. Buying Bitcoin is.

To buy bitcoin in your country, check our country guides:

…or visit our exchange finder if your country is not listed above.

What about transaction fees?

The second source of revenue for Bitcoin miners is the transaction fees that Bitcoiners have to pay when they transfer BTC to one another.

This is the beauty of Bitcoin. Every transaction is recorded in an unchangeable blockchain that is copied to every mining machine.

Bitcoin doesn’t rely on a central bank to keep records, it’s the miners themselves that keep the records, and they get to keep a share of the transaction fees as well.

Taxes on Bitcoin Mining Profits

Of course, while profiting on Bitcoin mining isn’t certain, paying taxes on your mining rewards is. Every miner needs to know the relevant tax laws for Bitcoin mining in his area, which is why it is so important to use a crypto tax software that helps you keep track of everything and make sure you are still making enough money after you account for taxes.

How do you know if you can profit from Bitcoin mining?

First of all, Bitcoin mining has a lot of variables. This is why buying bitcoin on an exchange can be a simpler way to make a profit. However, when done efficiently it is possible to end up with more bitcoin from mining than from simply hodling.

One of the most important variables for miners is the price of Bitcoin itself. If, like most people, you are paying for your mining hardware, and your electricity,- in dollars, then you will need to earn enough bitcoin from mining to cover your ongoing costs; and make back your original investment into the machine itself.

Bitcoin price, naturally, impacts all miners. However, there are three factors that separate profitable miners from the rest: cheap electricity, low cost and efficient hardware and a good mining pool.

1. Cheap Electricity

Electricity prices vary from country to country. Many countries also charge a lower price for industrial electricity in order to encourage economic growth. This means that a mining farm in Russia will pay half as much for the electricity you would mining at home in the USA. In places like Germany, well as you can see from the chart, that’s another story…

In practical terms. Running a Whatsminer M20S for one month will cost around $110 a month if your electricity is $0.045 kWh in somewhere like China, Russia or Kazakhstan. You can see from the table below that you would make $45 a month in May 2020 with those electricity prices.

Profitability with $0.045 kWh electricity

However, with the typical home electricity price in the USA, of $0.12 kWh, you would be running the machines at a loss from the start and it would not make sense to mine under these conditions:

Profitability with $0.12 kWh electricity

2. Efficient Hardware

So far in this article I’ve used the Whatsminer M20S as an example of the kind of machine you will need to mine bitcoin. These days there are several hardware manufacturers to choose from.

The price of hardware varies from manufacturer to manufacturer and depends largely on how low the energy use is for the machine vs the amount of computing power it produces. The more computing power, the more bitcoin you will mine. The lower the energy consumption the lower your monthly costs.

When choosing which machine to invest in, miners should think about the machine’s profitability and longevity.

Profitability is determined by the machine’s price per TH, how many watts the machine uses per TH, and your hosting costs.

Longevity is determined by the production quality of the machine. It makes no sense to buy cheaper or seemingly more efficient machines if they break down after a few months of running.

If the hosting cost is low enough, it often makes sense to prioritize the ‘price per TH’ over ‘watts per TH’, as your lower operational expenses (OpEx) will make up for the loss in your machine’s efficiency - and vice versa if your hosting costs are high.

The manufacturer with the lowest failure rate right now is MicroBT, who make the Whatsminer M20S and other Whatsminer models.

Bitcoin Mining Hardware Turnoff Prices

One useful way to think about hardware is to consider what price BTC would have to fall to in order for the machines to stop being profitable. You want your machine to stay profitable for several years in order for you to earn more bitcoin from mining than you could have got by simply buying the cryptocurrency itself.

The following table shows that the majority of the most modern machines could remain profitable at a bitcoin price between $5000 and $6000. Some machines could handle a drop below $5k, if they are being run with electricity that costs under $0.05 kWh.

Unfortunately most older machines are now no longer profitable even in China. The Bitmain S9 has been operational since 2016 and interestingly enough they are still being used in Venezuela and Iran where electricity is so cheap that it outweighs the risk of confiscation. There may, eventually, be more reputable sources of sub 2 cents electricity as the access to solar and wind improves in North America.

For the individual miner, the only hope of competing with operations that have access to such cheap electricity is to send your machines to those farms themselves. Not many farms offer this as a service though.

3. Reliable Mining Pool

These days, every miner needs to mine through a mining pool. Whether you are mining with one machine, or several thousand, the network of Bitcoin mining machines is so large that your chances of regularly finding a block (and therefore earning the block reward and transaction fees) is very low.

If the Bitcoin Network Hashrate is 100 EH/s (100,000,000 TH/s), a WhatsMiner M20S ASIC miner with 68 TH/s, has approximately a 1 in 1,470,588 chance of mining a Bitcoin block. With one block per 10 mins they may have to wait 16 years to mine that one block.

The oldest two pools are Slush Pool and F2Pool. F2Pool is now the largest Bitcoin mining pool and they support around 20% of the entire Bitcoin network.

F2Pool’s payout method is called PPS+. PPS+ pools take the risk away from miners, as they pay out block rewards and transaction fees to miners regardless of whether the pool itself successfully mines each block. Typically, PPS+ pools pay the miners at the end of each day.

This is how PPS+ pools calculate how much to pay out to miners in their pool. Here comes the science part…

If the Bitcoin Network Hashrate is at 85 EH/s (85,000,000 TH/s), a WhatsMiner M20S ASIC miner with 68 TH/s, will earn around 0.000702 BTC per day before pool fees.

0.000702 BTC is calculated by 68 (miner hashrate) ÷ 85,000,000 (network hashrate) × 144 (number of blocks per day) × 6.25 (block reward).

Pool fees are normally 2.50–4.00%, so let’s use 2.50% for the example; the net mining revenue is therefore 0.00068445 BTC.

If BTC is priced at $9,000, then this M20S has a daily revenue of $6.16.

Choosing the right mining pool is very important, as you will receive your mined bitcoin sent from the pool payouts every day. It’s important to choose a pool that is reliable, transparent and offers the right suite of tools and services to help you optimize your mining operation.

4. Fees When Selling Bitcoin

An often overlooked facet of mining profitability is the fees one pays to sell the Bitcoin one mines. If you are a small time miner, you may have to sell your coins on a retail exchange like kraken or Binance. Sometimes your fees are low but sometimes your fees are high - it really just depends on the fee structure of the exchange and the state of the orderbook at the moment.

However, if you are a professional miner like F2 or Bitmain, you likely have really advantageous deals with OTC desks to sell your coins at little to no fees - depending on the state of the market. Some miners are even paid above spot price for their coins. Either way, professional mining operations deal with Bitcoin at a large scale and so they have more leverage to get deals that are good for them, and this doesn’t just apply to electrcity purchases.

If you think you have what it takes be mine profitably, we suggest you make sure first by using our mining profitability calculator.

Professionals vs Amateurs

It’s common knowledge that it has become very difficult for individual miners to get access to the best machines and the cheapest electricity rates. Bitcoin farms that operate at scale use these advantages to maximize their returns.

As the difficulty of mining bitcoin increases, and the price lags behind, it is becoming harder and harder for small miners to make a profit.

It all comes down to scale and access to cheaper prices. When people enter the space, without prior relationships, they struggle to compete with established mining operations.

Bitcoin mining is starting to resemble similar industries as more money flows in and people start to suit up. With increased leverage, margins are lower across the whole sector. Soon, large scale miners will be able to hedge their operations with financial tooling to lock in profits, whilst bringing in USD denominated investments like loans or for equity.

As mining becomes more professional, it will make things even harder for DIY miners.

Can you Mine direct to an exchange?

If you have put in the effort to learn about mining, and you have found a location with low cost electricity for your machines, then you still need to consider where to store the bitcoin that you mine.

It is possible to mine direct from the pool to an exchange, but we recommend you keep your bitcoin in a wallet where you have access to the private keys.

Here are our top picks for Bitcoin wallets:

COMPARISON

How To Cash Bitcoin In Usa

Ledger Nano X

- SCREEN:

- RELEASED: 2019

- PRICE: $119

Ledger Nano S

- SCREEN:

- RELEASED: 2016

- PRICE: $59

TREZOR T

- SCREEN:

- RELEASED: 2018

- PRICE: $159

TREZOR One

- SCREEN:

- RELEASED: 2013

- PRICE: $59

Is CPU mining profitable?

No, and in the case of Bitcoin, it almost never was. unless you were one of the very first people to mine Bitcoin, CPU mining has never been profitable. There was a time where one could profitably mine Bitcoin with GPUs, but again…today, you really must have an ASIC and a deal witha power company to make any money mining Bitcoin in 2020.

Final Thoughts

The average home miner is unlikely to recoup the cost of mining hardware and electricity. Profiting on your own is highly unlikely.

The situation may improve in the future once ASIC mining hardware innovation reaches the point of diminishing returns. That, coupled with cheap, hopefully sustainable power solutions that retail customers can access in some shape or form, may once again make Bitcoin mining profitable to small individual miners around the world.

If small miners can re-enter the network it greatly increases decentralization and supports the original intentions of Satoshi Nakamoto even further.